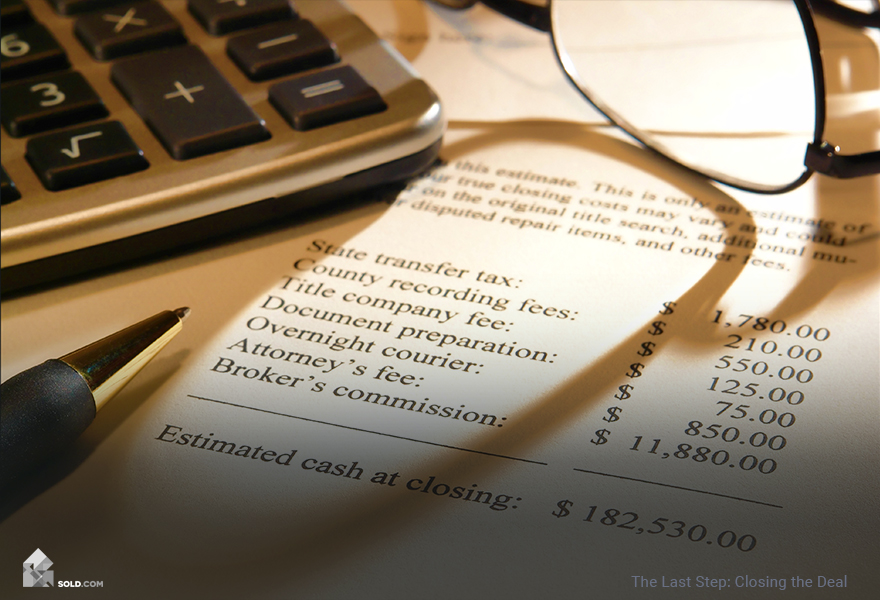

Your real estate transaction is coming to a close — but before celebrating, you’re going to have to deal with closing costs or the expenses associated with a home sale that will be paid at the close of the transaction. Closing, by the way, is defined as the moment when the property title goes from the seller to the buyer.

Closing Costs

While these certainly can vary, expect to encounter any combination of the following:

- Appraisal

- Attorney fee (attorneys are not required in all states)

- Escrow fee, which goes to the title company, escrow company, or attorney who oversees the closing of the transaction

- Home inspection, which serves as verification of property condition and proof that negotiated repairs have been handled

- Homeowners’ insurance — the first year’s fees are typically paid at closing

- Lender’s policy title insurance, which is proof that you own the home and that your lien is valid

- Pest inspection, which covers termite inspection as well as inspection for dry rot, required in some states as well as for government loans

- Property tax, which typically must be paid within 60 days of purchase

- Recovering and survey fees

- Title company title search or exam fee

- Transfer taxes

Keep in mind that closing costs tend to run anywhere from 2% to 5% of the total transaction amount. They are also highly negotiable, something your agent will make sure you keep in mind.

Title Insurance and Escrow

These are both key elements of transferring property from seller to buyer. In this case, the word title refers to all legal rights of use, ownership, and disposal of property, including all previous uses, ownership, and transfers. You will need to prove your right to sell this property; this is accomplished by a title search through your insurance company.

Title insurance can either be a lender’s or an owner’s policy. In the former case, the lender’s interest in the amount of the mortgage loan is protected; in the latter, the buyer is covered for the property’s full value. It is also protection against any forged deeds, deeds by persons of unsound mind, liens for unpaid taxes, deeds by minors, mistakes in legal documents, and other types of fraud. Your title-insurance firm charges a single premium in exchange for handling all legal challenges to your property’s title.

Escrow is defined as a transaction in which a neutral third party — known as an escrow agent — holds a written instrument, money, or other items of value during sale, transfer, or lease of a real or personal property. In other words, your escrow agent acts as a middleman responsible for carrying out written instructions from you and your buyer.

You’ll have to provide information to your escrow agent that includes some or all of the following:

- Tax statements

- Fire and other insurance policies

- Loan documents

- Sale terms

- Any financing obtained by the buyer

- Requests for services to be paid out of escrow funds

If financing is required, the buyer is responsible for providing documentation of any and all new loan agreements. Once all instructions have been followed, it’s time for the transaction to close.

Home Inspection

As opposed to a final walk-through, a final home inspection is conducted by a professional to assess the condition of your home. Here are a few of the major categories for inspection:

- Roof

- Foundation

- Climate-control systems (heating and cooling)

- Plumbing

- Electrical systems

- Sewage

- Water

- Fire and safety issues

- Any evidence of damage that could, in turn, affect property value

For more helpful home selling tips and advice, visit Sold.com! For personalized home selling options and tips, take our Home Seller Quiz now!

The home inspector must then write a report that includes any recommended repairs, concerns about home maintenance, or any other related issues. The inspection timeline is specified in the contract — there is typically a short period during which it must be performed — and should your buyers not be satisfied with the results, they typically have the right to cancel the deal. The professional inspection will come before the walk-through, which is arranged by your agent. More formal walk-throughs are detailed in an addendum to the purchase contract.

Final Walk-Through

The purpose of a final walk-through — which should not be confused with a property inspection as it is not meant to be a point of further negotiation — is to ensure that the home is left in the condition agreed to in the purchase contract.

These items should be checked during the final walk-through:

- Run the water, checking for leaks

- Check garage-door openers

- Open and close all doors

- Turn every light fixture off and on

- Flush toilets

- Test all appliances

- Test climate-control system (heating and air conditioning)

- Run the exhaust fans and garbage disposal in the kitchen

- Inspect walls, ceilings, and floors

- Ensure all debris and personal property is removed from the home if it is unoccupied

If the home is still occupied during the final walk-through — which can happen — this is a chance for buyer and seller to chat about any quirks of the home and exchange contact information so that the buyers can forward mail or get in touch for any other necessary reason. Learn more about terms above by reading our Home Seller FAQ.